arizona solar tax credit 2019

In 2019 the maximum credit allowed for single. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system.

The Extended 26 Solar Tax Credit Critical Factors To Know

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in.

. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Tax Incentives For Solar Conversion AZ Convert To Solar And Save Phone. This practice is commonly known as swapping does not result in a contribution eligible for the tax credit.

Credit For Solar Energy Credit Arizona Form 310. In most cases you will have to provide evidence to show that you are eligible for the tax credit and calculate. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies.

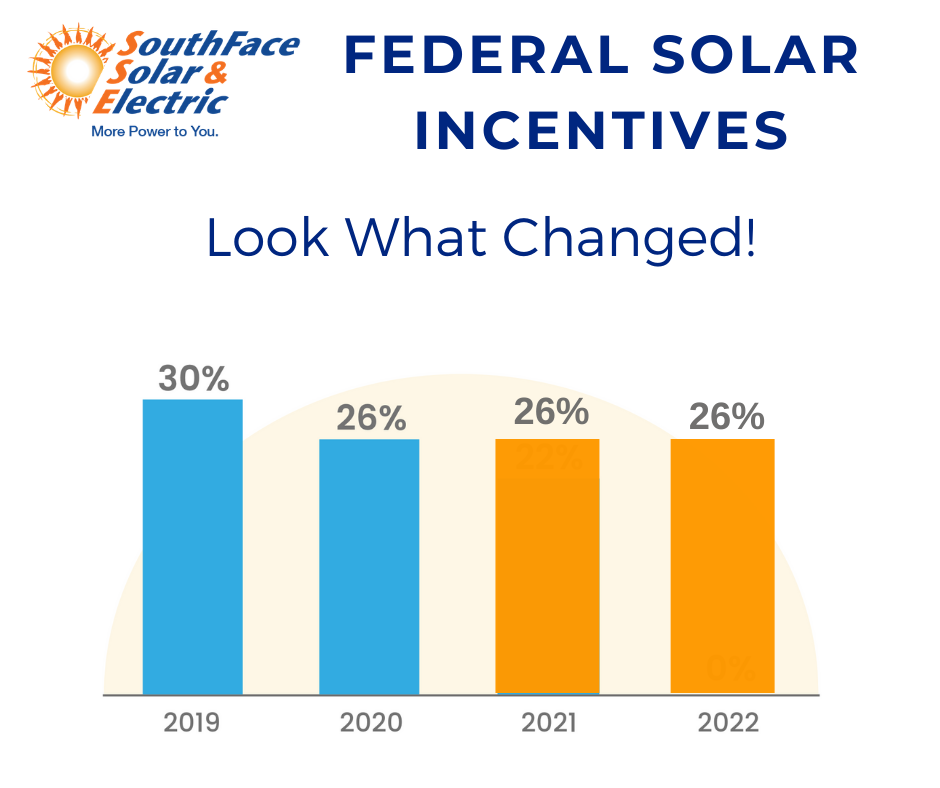

The solar Investment Tax Credit ITC is one of the most beneficial federal policies in place to support the expansion of solar energy usage in the United States. Buy and install a new home solar system in Arizona in 2021 with or without a home battery and you could qualify for the 26 federal tax credit. 23 rows Did you install solar panels on your house.

This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43. Tax Incentives For Solar Conversion AZ Convert To Solar And Save Phone. The credit is allowed against the.

Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. The federal ITC remains at 26 for 2022. Along with tax rebates and exemptions from the State of Arizona you also can benefit from the Federal Solar Investment Tax Credit ITC which is a.

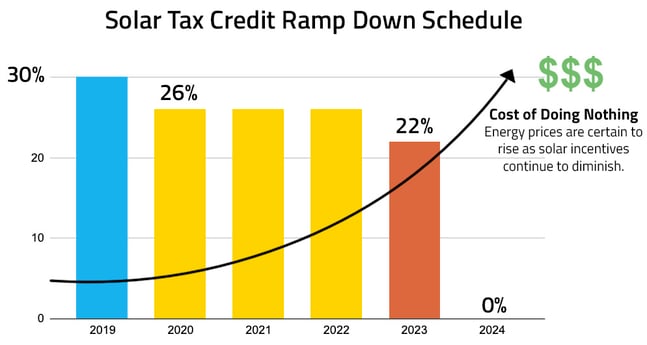

Federal Tax Credit. Bitly2UO9Nyq If you are thinking about going solar now is the time to do it. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be. To claim the solar tax credit youll. The residential ITC drops to 22 in 2023 and.

However the scope of this tax credit has expanded starting with 2019 tax year according to Ed Greenberg of the Arizona Department of Revenue who notes For public schools one change. The tax credit amount was 30 percent up to January 1 2020. Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

Claiming the federal ITC involves determining your tax appetite and filling out the proper forms. Head of household and married filing.

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

Solar Tax Credit In 2021 Southface Solar Electric Az

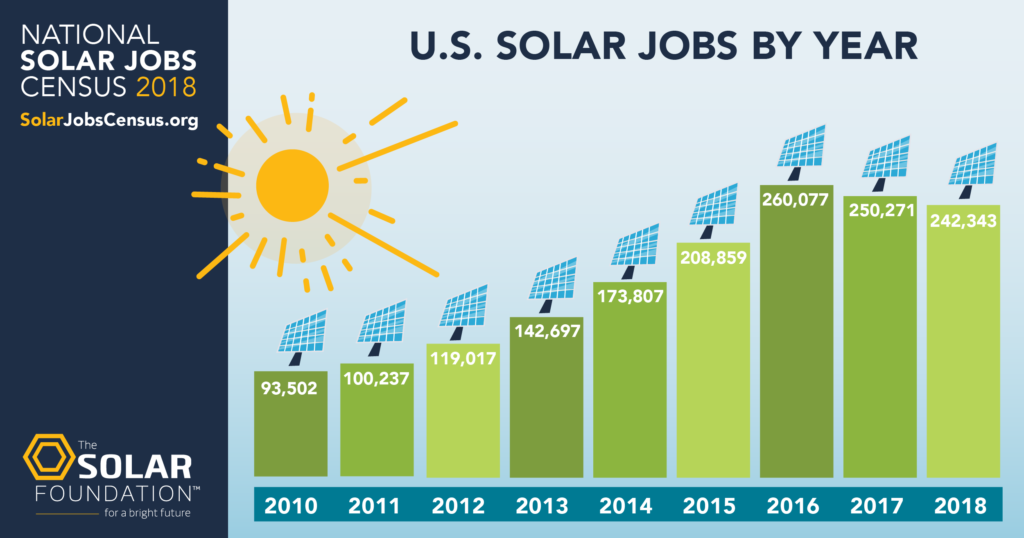

Solar Energy Industry Jobs Nc Clean Energy Technology Center

Federal Solar Tax Credit 2022 How It Works How Much It Saves

How Does The Federal Solar Tax Credit Work Freedom Solar

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

Solar Energy Facts That May Surprise You Forbes Advisor

Free Solar Panels Arizona What S The Catch How To Get

Energy Solar Power House Solar Energy Panels Solar

Are Solar Panels Worth It In Arizona Yes Ae Llc

Solar Tax Credit Details H R Block

Pin By Solar Electric Power Company On A Light For All Solar Energy Climate Reality Solar Energy Solar

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

How Your Business Can Claim The Solar Tax Credit Legalzoom Com